EU Tax VAT and packages from Aliexpress. The European Union introduces new Value-Added Tax rules for e-commerce from 1 July 2021. What is changing from 1 July 2021?

According to the VAT rules applicable up until 1 July 2021, no import VAT has to be paid for commercial goods of a value up to EUR 22.

The new VAT e-commerce rules will abolish this provision as of 1 July 2021. Thus, from 1 July 2021, all commercial goods imported into the EU from a third country or third territory will be subject to VAT irrespective of their value. The new rules are designed to create a fairer trading environment, by introducing new rules to ensure that VAT is charged regardless of the supplier’s location.

The changes will affect all EU consumers as they will now have to pay VAT on all their online purchases outside the EU, and sometimes directly to the postal operator.

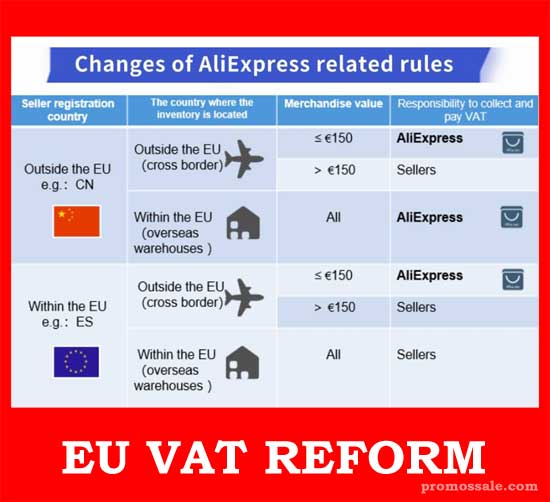

What changes will buyers and sellers have on Aliexpress? Aliexpress has developed rules to enforce EU laws, avoid double taxation, and facilitate shopping.

EU Tax and AliExpress. What is changing?

- Aliexpress has changed the rules for sellers who ship goods to Europe. Sellers are now responsible for paying tax liabilities related to platform commissions and other service charges.

- AliExpress will provide sellers with automatic tax calculation tools in selected countries and regions. These tools make it easier for sellers to calculate the applicable taxes and fees.

- From July 1, Aliexpress will use the Single Import Store (IOSS) system. The IOSS facilitates the collection, declaration and payment of VAT for sellers that are making distance sales of imported goods to buyers in the EU. The IOSS also makes the process easier for the buyer, who is only charged at the time of purchase, and therefore does not face any surprise fees when the goods are delivered.

- Aliexpress collects taxes from sellers and transfers them to the appropriate local tax authorities. This prevents customs double taxation of goods when imported.

- A buyer who buys goods on Aliexpress for less than 150 euros does not pay fees upon receipt of the parcel.

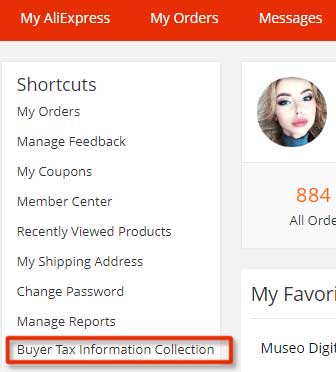

- In the personal account in the section “My Aliexpress”, a user from Europe must fill in the data of the tax account.

- The “Tax Label” will be used on parcels delivered to the EU.This “Tax Label” will inform the authorities whether the value added tax has already been charged on the parcel or not. The label will be in use from 1 July 2021.

- Combined Delivery does not work if the goods fall under a different category of customs clearance. Items that are not taxable on the platform are prohibited from being packaged and shipped in the same packaging as taxable items.

- If a seller on Aliexpress sells several goods to the same buyer, and these goods are shipped in a package amounting to more than EUR 150, then you do not need to pay VAT on Aliexpress. These goods will be taxed at importation in the EU Member State.

Aliexpress Sale Dates 2021 | Shopping Events Calendar

Aliexpress Seller Promo Codes

Customs duty – If your goods have an intrinsic value (the value of the goods alone excluding transport, insurance and handling charges) of more than €150 you will have to pay Customs Duty. These monetary limits apply to the whole consignment, not just one item. You must pay the above duties where applicable.

EU countries are: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, The Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden.

What is VAT?

VAT is a kind of tax on consumer spending that varies from country to country in the EU. Standard rates range from 17% (Luxembourg) to 27% (Hungary). The VAT rates of AliExpress in key EU countries can be referred to as follows: Spain (21%), France (20%), Poland (23%), Belgium (21%), Italy (22%), Germany (19%), Netherlands (21%).

Two major changes of EU tax reform

1 Removing of Exemption for the Importation of Goods valued at less than EUR2:‘

2 AliExpress will calculate and pay VAT in some cases.

Do I have to pay VAT on goods from AliExpress?

You may be charged customs duties and taxes for something you bought on AliExpress. But from July 1, on Aliexpress, the cost of VAT will be included in the price of the goods .. You will not need to pay additional taxes.

How do I avoid taxes on AliExpress?

If you are in Europe and order from the Aliexpress website, then if the value of the goods is less than 150 euros, VAT will be automatically included in the price of the goods. If the product costs more than 150 euros, then you need to pay taxes upon receiving the parcel.

I ordered before 1 July, do I need to pay for VAT for goods receiving?

For Transitional Period goods, since they are ordered before 1 July, our IOSS number cannot be used to simplify the importation process. You may be contacted by the logistics partners for the relevant import VAT and charges, subject to the implementation practice of the respective EU customs authority and the logistics partners.

If you purchased from a shipping location based in the EU, since the goods are already in the EU and any taxes should have been reflected in the price offered by the seller, you shall not be charged of any additional taxes after purchase.

Where can I get invoice for my order with VAT?

A: Invoices are available for all orders on which AliExpress has collected VAT at check-out. You can find your invoice on following path: My Orders / All Orders/ Download Invoice

What should I do if I was charged VAT and other fees by the customs/logistics provider but my order was collected of VAT

If you have paid for order with VAT in AliExpress, VAT should not be charged again by customs/logistics provider.

In case you were charged again, please keep the invoice and submit it to customer service team to get refund of it.

Documents required:

1. invoice of import VAT issued by this logistics service provider (with tracking# and VAT amount)

2. proof of payment for that invoice

3. any customs document on the release of the goods, including the shipping label of the package

Will my VAT refund if my order is refunded?

For orders where AliExpress wasn’t collecting VAT, it is usually for the buyers and sellers to discuss on how to handle the relevant tax matters. You may further check with the sellers and relevant tax / customs authorities to understand more about this. For orders where AliExpress collected VAT, AliExpress will refund the VAT as appropriate to you. AliExpress will calculate and refund the VAT as appropriate for your refunded or partially refunded orders. A credit note will also be issued accordingly.

How does the IOSS work?

Sellers registered in the IOSS need to apply VAT when selling goods destined for a buyer in an EU Member State. The VAT rate is the one applicable in the EU Member State where the goods are to be delivered. Information on the VAT rates in the EU is available on both the European Commission website and on the websites of national tax administrations.

Since the low-value consignment exemption will be abolished, postal operators and couriers will have to check all products for customs clearance and, in many cases,

It will also affect online ecommerce giants like EBAY, Amazon, ETSY, etc.

For EU consumers who buy from a seller on Ali Express registered with IOSS, from 1 July 2021, VAT will be included as part of the price that has to be paid to the seller. That means no more calls from Customs or courier services asking for an extra payment when the goods arrive in the buyer’s home country.

The EU VAT rules are changing soon. Buying goods online for personal use. dropshipping

European Union VAT

Super Code promo available on all deals!

VAT will be incl. at checkout

Valid from Jul 1 to Jul 1

Not applicable on virtual items(ex, event tickets)

J’ai acheté des produits TVA incluse sur Aliexpress et la poste m’a demandé de payer la TVA

et des frais de dédouanement

Il faut te faire rembourser la TVA par aliexpress, cherche dans leur base de données d’aide “If the post office asks me to pay tax (VAT) again when I receive the goods, how should I get the tax back?”

Ils remboursent sous 48h.

https://servicehall.aliexpress.com/knowledgeDetail?hcAppId=1248&hcFromCode=Xn2Tk1tb7&hcSessionId=26-1248-0941a4ab-d22d-4600-abe2-36518b3f9f18&spm=service_hall.24300488.searchresult.648101&knowledgeId=648101&categoryId=21039537